Did you know that you may be able to make voluntary contributions to super to help save for a deposit on your first home? What are the potential benefits of using super? We explain more about the scheme below.

Tell me the basics – how does it work?

When it comes to saving for your first home, super probably isn’t an investment option that springs to mind. Generally, super can only be accessed once you’ve retired or met another ‘condition of release’, which could be a long way down the track.

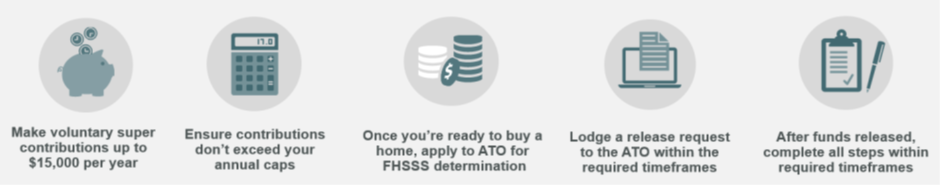

However, under the First Home Super Saver Scheme, you may be able to make voluntary contributions to super, and you may be eligible to withdraw these amounts, plus associated earnings to put towards a deposit on your first home. Below, we highlight the key steps you need to follow.

Why use super to save?

There are a few potential benefits to using super to save for a home deposit, including:

- earnings in super are taxed at up to 15% and are concessionally taxed when you make a withdrawal from super under the scheme. Earnings on investments or bank accounts in your own name are taxed at your marginal tax rate (MTR) which could be up to 47%[1], and

- depending on the type of contributions you make, these amounts may reduce your taxable income for the year and therefore reduce tax payable.

The tax effectiveness of the scheme may free up more of your hard-earned funds and increase the amount you can save for that home deposit.

Am I eligible?

To be eligible for the FHSSS, you must meet certain conditions, including:

- be aged 18 years or older at the time you apply to withdraw the funds

- have not ever owned or had an interest in Australian real estate (including residential, investment and business properties) unless you meet financial hardship provisions, and

- make voluntary super contributions.

What contributions can I make and access under the FHSSS?

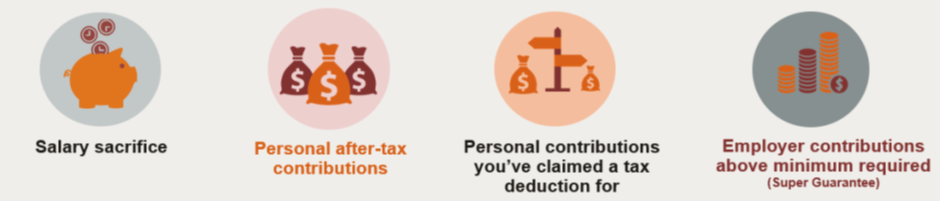

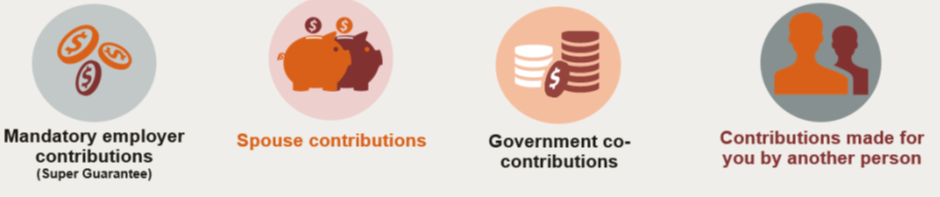

You can make voluntary contributions of up to $15,000 per year within your ordinary contribution caps and can withdraw a maximum of $50,000 of voluntary contributions plus earnings on the amount you withdraw. You can read more about the different types of contributions and contribution caps at ato.gov.au.

Voluntary contributions include:

Voluntary contributions do not include:

Applying to have funds released

There are some important steps and timeframes you must understand.

1. Request and receive a FHSS determination

A FHSS determination provides you with the maximum amount you’re eligible to withdraw. You can request a determination via myGov. You’ll need to have requested and received a determination from the Australian Taxation Office (ATO) before signing a contract of sale or for construction[2], or purchasing a home at auction. If you don’t, you won’t be eligible to access the contributions you’ve made to super.

2. Request to withdraw funds

Provided you’ve received your FHSS determination, you may request to release (or withdraw) an amount up to the figure noted in the FHSS determination before or after you sign a contract. However, if you apply for the release authority after you’ve signed a contract, you need to make the request within 90 days of entering a contract. A release request can be made via myGov.

After the funds are released, there are additional requirements and obligations – see below.

Taxation of funds

Some of the amount withdrawn is subject to tax (known as the assessable amount). This includes any concessional contributions[3] that are released to you, plus any associated earnings that have accrued on any of the contributions released to you (either concessional or non-concessional). The assessable amounts are taxed at your MTR less a 30% tax offset. The ATO will estimate your income for the year in which you withdraw the funds and will withhold tax from the amount paid to you at your estimated tax rate[4].

What happens after applying to release funds?

It generally takes the ATO between 15 and 20 business days after your release request to send the funds to you (see ato.gov.au). You’ll need to purchase a home or sign a construction contract within 12 months of receiving the funds. If you don’t, the ATO automatically provides an additional 12 month extension to you, and will notify you in writing. After you sign a contract, you must notify the ATO within:

- 28 days, if using a FHSS determination dated on or before 14 September 2024, or

- within 90 days if using a FHSS determination dated on or before 14 September 2024.

You must move into your home as soon as possible after purchase or construction is complete, and you must intend to live there for at least six of the first 12 months.

If you still haven’t purchased a home or signed a construction contract within that timeframe, you’ll need to either:

- recontribute the funds to super as a non-concessional contribution[5] for which you can’t claim a tax deduction and notify the ATO via myGov, or

- pay FHSS tax of 20% on the assessable amount that was released to you, which is in addition to any tax payable on the withdrawal[6].

What if you change your mind?

If you change your mind after you’ve contributed to super and no longer intend to purchase a home, the money you’ve contributed to super won’t be accessible.

If you change your mind after the funds have been released, you’ll need to either recontribute the money to super, or pay additional FHSS tax. If you change your mind before the funds have been released, you can amend or withdraw your FHSSS application. You can then re-apply in future should the need arise once you have withdrawn your application.

What next?

To find out more about the FHSSS and to understand the different ways you can contribute, and the benefits it may provide to you, we recommend you seek financial advice and visit ato.gov.au. You may also be eligible for state/territory based stamp duty concessions or first home buyer grants and you should seek further information from the revenue office in your location.

IMPORTANT INFORMATION: This document has been prepared by Periapt Advisory Pty Ltd, ABN 67 648 208 253 AFSL 542418, based on our understanding of the relevant legislation at the time of writing. The information is of a general nature only and has been prepared without consideration of any particular individual’s objectives, financial situation, or needs. Before making any decisions, we recommend you consider independent financial advice. Current at 10 February 2025.

[1] Including Medicare Levy

[2] If you’re building a home, you need to ensure you have applied for a FHSS determination before purchasing vacant land

[3] Concessional contributions include personal contributions which you have claimed as a tax deduction and salary sacrifice amounts

[4] If the ATO can’t estimate your income for the year and therefore your MTR, they will withhold tax on the assessable amount at 17% and any adjustment will occur when you submit your tax return for the year.

[5]The contribution counts towards your non-concessional contribution cap. Tax penalties may apply if you exceed your cap.

[6] This will also apply if you recontribute the amount to super but you don’t notify the ATO