Non-concessional contributions (NCCs) include personal contributions made to super from after-tax income or other available savings. Limits apply to the total NCCs that you can contribute to super without exceeding your contribution limit. To help avoid breaching the cap, you can access your contribution information on myGov.

What are non-concessional contributions?

Non-concessional contributions (NCCs) include those made with after-tax money, such as your take home pay, or funds in your bank account. NCCs may provide significant opportunities to build super for retirement. NCCs form part of the tax-free component of your super interest and are not taxed when released from super.

NCCs commonly include:

- personal contributions for which a tax deduction is not claimed

- spouse contributions

- excess concessional contributions not released from super, and

- certain amounts transferred from a foreign super fund.

Am I eligible to make NCCs?

To be able to make NCCs, you need to meet certain eligibility rules. This includes:

- you’re aged under 75 at the time you make the contribution[1], and

- your ‘total super balance’[2] at the previous 30 June is less than certain limits (see below).

Limits on NCCs

Like other contribution types, there are limits on the total amount of NCCs you can contribute to super and penalties apply if limits are breached. For more information on excess contributions, see ato.gov.au.

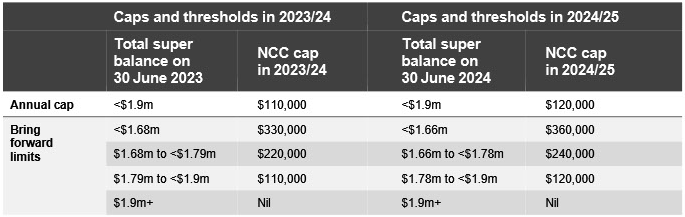

In 2024/25 the annual NCC cap is $120,000. However, depending on your total super balance, you may be able to use the bring forward rule to make even larger contributions sooner. This rule may enable you to bring forward up to two years’ worth of NCCs in addition to the current year’s cap.

What’s my limit?

Your eligibility to contribute up to the annual NCC cap – or larger amounts under the bring forward rule – is determined based on your total super balance. The limits for the current and next financial years are summarised in the table on the following page. You can check your total super balance details using myGov.

A subsequent post deals with how to access your total super balance details.

How to access non-concessional contribution details on myGov

There are a few ways you can monitor your NCCs and to check whether you’re currently in a bring forward period.

The steps to using myGov to access NCC information are explained below. However, it is recommended that detailed records also be maintained and referred to. This is because there may be a delay before your super fund reports details about your contributions to the ATO. Remember, additional tax applies for excess contributions.

Note: The below screenshots and scenarios relate to different fictional individuals and are used to show you the possible NCC and bring forward data on myGov.

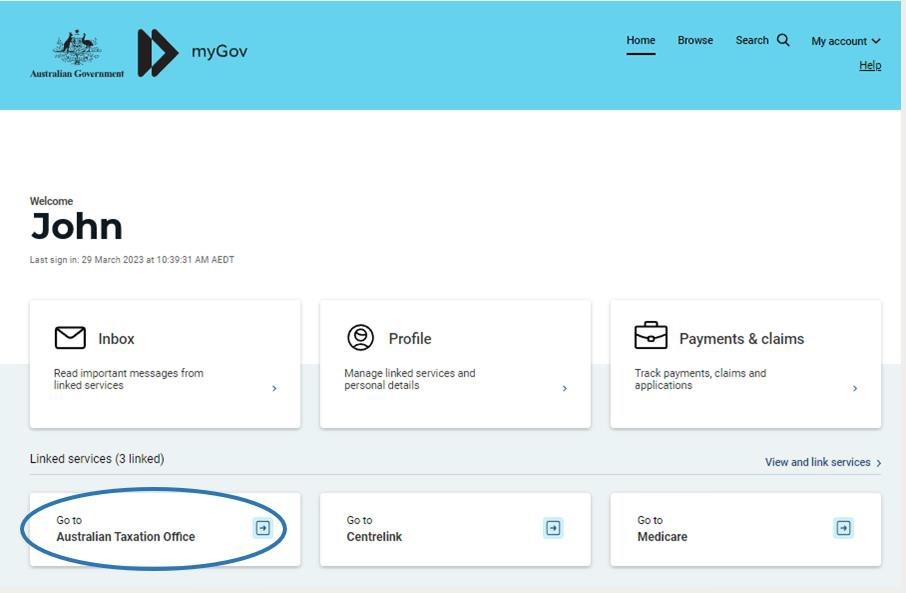

Step 1: Login to your myGov account by visiting my.gov.au and select the ATO service

Don’t have a myGov account? Use the link below and follow the steps. Click here for instructions on how to create a myGov account or visit: https://my.gov.au/en/about/help/mygov-website/create-mygov-account

Haven’t linked your myGov account to the ATO? Use the link below and follow the steps. Click here for instructions on how to link the ATO to myGov or visit: https://my.gov.au/en/about/help/mygov-website/link-services-to-your- account/link-the-australian-taxation-office

Step 2: Select the ATO service

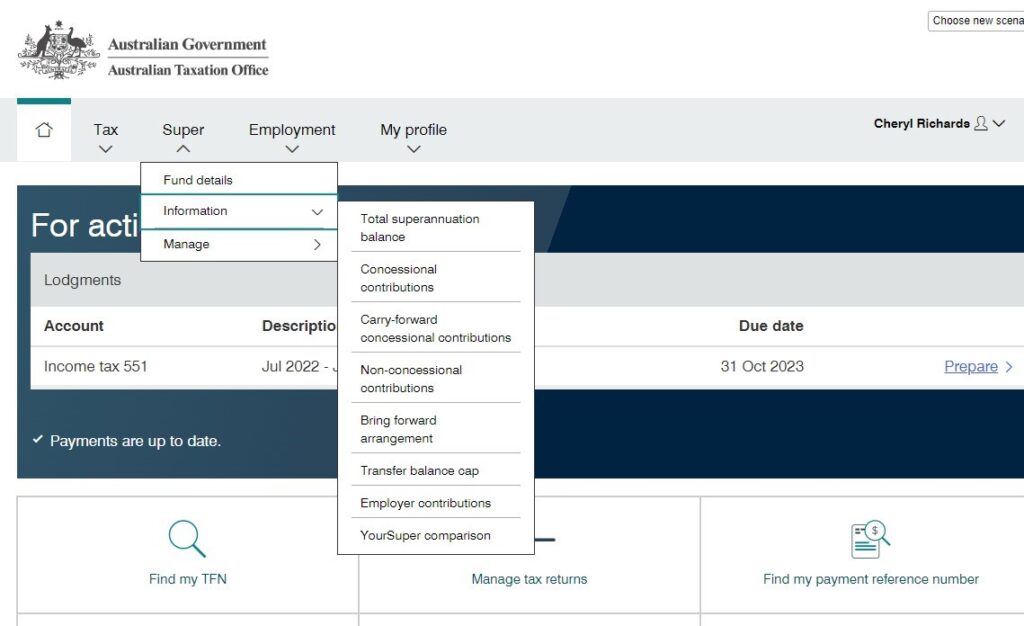

Step 3: Select the ‘Super’ tab

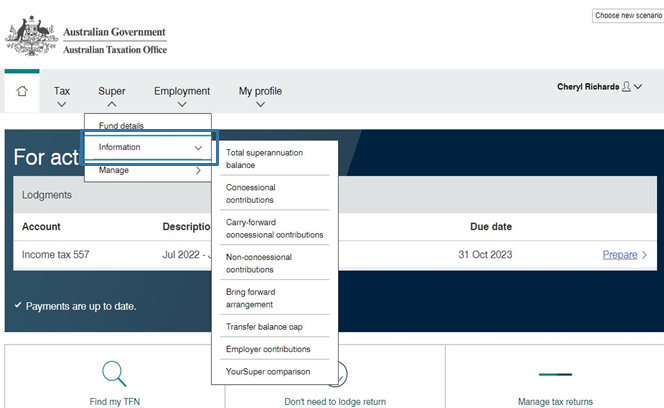

Step 4: For information on NCCs, click on the ‘Information’ option and a second menu will be revealed. Click ‘Non- concessional contributions’.

Step 5: For information on NCCs, click on the ‘Information’ option and a second menu will be revealed. Click ‘Non- concessional contributions’.

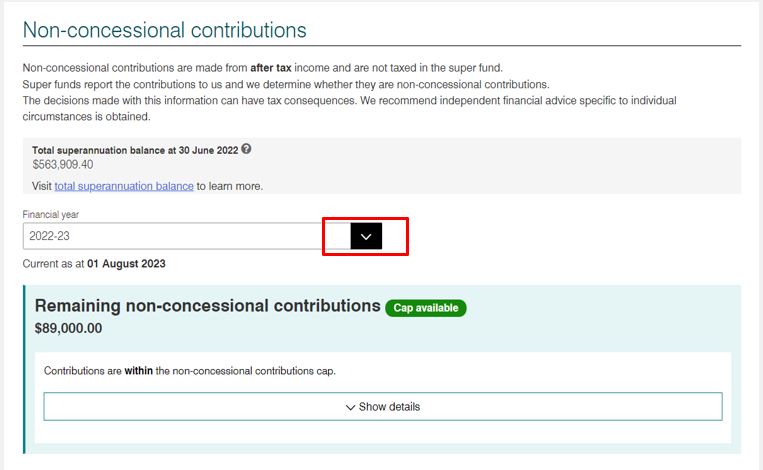

Use the arrow (red box) to reveal a drop-down list to select a financial year. Information regarding the NCCs made during that period will be displayed.

Your TSB as at the 30 June prior to the relevant financial year is displayed, provided ATO have this information. See note below

Click on ‘show/hide details’ (black box) to reveal the NCCs reported to the ATO for the period selected. In this example, the person has $89,000 of their NCC cap remaining

Note: The information shown reflects the information that the ATO has received from your super funds to that point. If there is a delay in any of your funds reporting to the ATO, or there has been an error in reporting, the information displayed will not be accurate. Funds do not report your 30 June total super balance often until some months into the new financial year. It is important to maintain your own records and ascertain contribution information from other sources, such as your super fund or financial adviser, to determine contribution eligibility.

Step 6: For information on bring forward arrangements, click the ‘Super’ tab, and then ‘Information’ to reveal a second menu. Select ‘Bring forward arrangement’

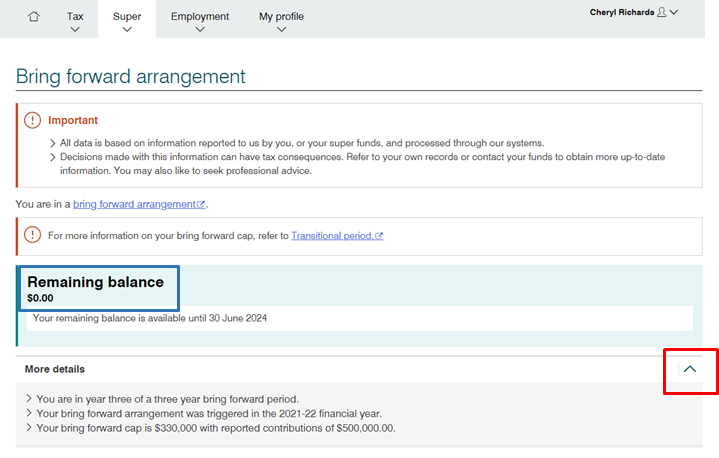

Step 7: This screen will display information regarding any bring forward arrangement that you may be in. This means you may have previously triggered the bring forward rule within the last three years.

Your available NCCs will be displayed in the ‘remaining balance’ box (blue box). For an explanation of the amount displayed, click on the drop down arrow (red box). As seen in this example, the individual is currently in a three year bring forward period, after triggering the arrangement in 2021/22. They have fully utilised their available limit.

Next steps

Contribution rules and eligibility criteria for NCCs and the bring forward provisions are complex. This guide is not designed to provide comprehensive information about how the rules work or how they may apply to you. It is recommended that you speak with an independent financial adviser and visit ato.gov.au for more information.

IMPORTANT INFORMATION: This document has been prepared by Periapt Advisory Pty Ltd, ABN 67 648 208 253 AFSL 542418, based on our understanding of the relevant legislation at the time of writing. The information is of a general nature only and has been prepared without consideration of any particular individual’s objectives, financial situation, or needs. Before making any decisions, we recommend you consider independent financial advice. Current at 10 January 2025.

[1] Contributions must be received by your fund no later than 28 days after the month you turn 75

[2] Total super balance includes the total of all amounts you hold in super accumulation and pension accounts, in-transit rollovers, and if you have a self-managed super fund, it may also include the outstanding balance of a limited recourse borrowing arrangement. The total Is reduced by personal injury or structured settlement contributions made to super.