Despite what Hollywood would have you believe, it is not possible to rule from the grave. However, in Australia, you can exercise a great deal of control through a properly drafted Will and the use of testamentary trusts.

Here, we get the lowdown on these powerful estate-planning mechanisms from Tara Lucke, specialist lawyer and Group Principal at the Nexus Law Group, about why considering a testamentary trust is a vital step for an effective estate plan.

Testamentary trusts are one of my absolutely favourite estate planning tools. You’d be crazy not to use one!

I like to think of them as the super hero of estate planning, because they will save your family tax after you die, save your inheritance from divorce and bankruptcy risks and save young children from wasting their inheritance. What’s not to love?

Here’s the low down of what you need to know about testamentary trusts:

- Testamentary trusts should save your family tax after you die

- Testamentary trusts should protect your inheritance from divorce and bankruptcy risks

- You only get one chance to access the fantastic estate planning benefits of a testamentary trust – it MUST be in your Will when you die

- Testamentary trusts are not administratively burdensome – any extra compliance should be far outweighed by the tax savings

- Testamentary trusts only start working if you die – the benefits don’t start until you die but neither do the (minor) compliance requirements

- When in doubt, use a testamentary trust

Give it to me straight… What is a testamentary trust?

The phrases “testamentary trust”, “testamentary discretionary trust”, TT, TDT are all just “lawyer-speak” for a trust set up in a Will that starts when the Willmaker dies. It sounds complicated, but they are essentially the same as a family trust (more technically known as a discretionary trust). The only real difference is a testamentary trust is established by a person’s Will and remains dormant, ready to start only when a person dies.

How does the testamentary trust work?

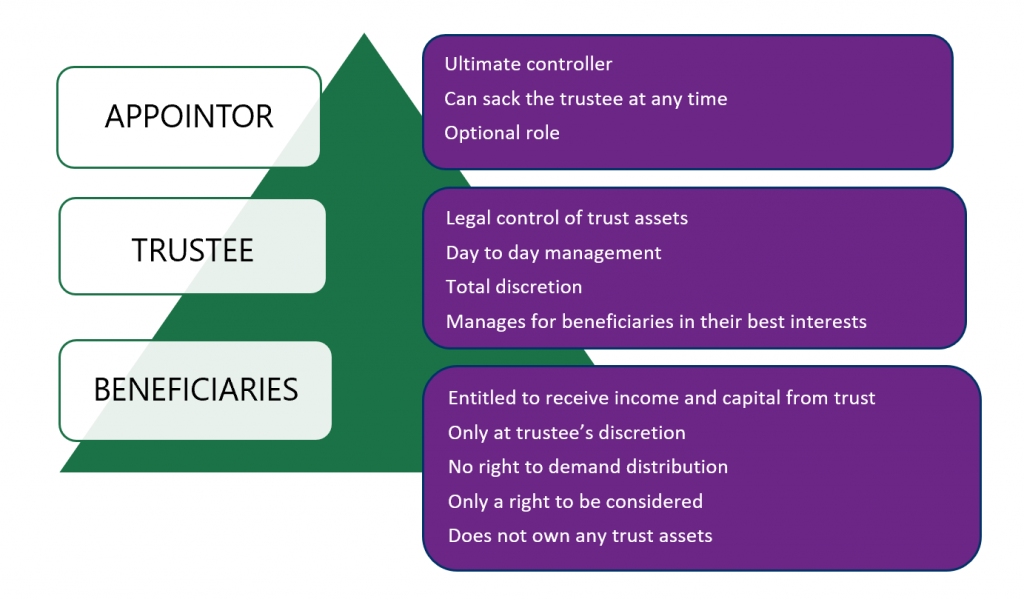

Trusts work by separating control of the assets held in the trust from the benefit. The person who has control of the trust assets is the Trustee. The Trustee is the legal holder of the assets and is responsible for the day to day management of the trust and the due administration of the trust.

An effective testamentary trust should have many people who can potentially benefit from the assets in the trust (the technical term for these people are Beneficiaries) and each beneficiary’s entitlement should be at the complete discretion of the Trustee.

This discretionary nature of the trust is what makes the trust so powerful for asset protection. Because none of the beneficiaries own the trust assets and their only right is to be considered by the trustee, it is very difficult for someone to argue that the underlying assets of the trust belong to any one of the beneficiaries. If a particular beneficiary is sued or goes through a family law property settlement, it is very difficult for their creditor to access the assets in the trust to satisfy the claim against that particular beneficiary.

A trustee can also be one of the beneficiaries of the trust, and if that is the case, then the trust assets will “look and feel” more like that person’s assets because they are in control and can choose themselves or their family members to benefit from the trust. If you are simply a beneficiary without being a trustee, then your entitlements in the trust are at the trustee’s behest.

The key benefits of a testamentary trust are:

- Increased protection of the inheritance from Family Law property settlement risks

- Protects immature (and financially immature) beneficiaries

- Income tax flexibility

- You can (nearly!) rule from the grave

- It can defer tax for overseas beneficiaries

- Bankruptcy protection

Testamentary trusts offer fantastic tax flexibility (Don’t tune out now! Stick with me here, I promise you will find this useful!).

In fact, testamentary trusts are the only environment where you can get such great tax treatment, and it’s only because someone had to die for the trust to start (currently, the government does not recognise dying as a tax avoidance strategy… at least for now!).

In essence, trusts are “flow through” vehicles for tax purposes, which means the income earned each year from investing the trust assets always needs to be distributed out to beneficiaries and each beneficiary gets taxed on the income they received from the trust at their own marginal tax rate. Each year the trustee can choose which of the beneficiaries should receive the income earned from investing the inheritance each year, which allows them to give income to beneficiaries who have lower tax rates.

Testamentary trusts offer an additional benefit which is not available to any other type of trust – beneficiaries under 18 are treated like adults for tax purposes which means they can receive about $20 000 tax free each year (and no, you cannot get these tax free amounts now; unfortunately you do have to die before these tax savings start!).

CASE STUDY: YOU HAVE CHILDREN UNDER 18

A testamentary trust is a very powerful tool for families with young children. In particular, the testamentary trust offers the following advantages:

- Your surviving spouse might re-partner after you pass away (after a suitably long mourning period) but the inheritance you leave your family will be protected for your children in the trust away from the influence of any new partner and protected from any future family law property settlement risks.

- If you and your spouse both pass away together, your children won’t automatically get their hands on their inherence when they turn 21 (which is the case if you don’t use a testamentary trust). You can choose who is responsible for making financial decisions about the inheritance until the children reach financial maturity. How many people have you heard of who came into their inheritance far too early and wasted the lot?

- The tax treatment could make a huge difference to your family’s financial wellbeing.

For example: If you die leaving a spouse and 3 minor children, then roughly the first $62,000 of income earned from investing the inheritance through the trust could be tax free and used to pay for the children’s living and education expenses. If you didn’t have a trust, then your surviving spouse would need to pay tax on that income at their marginal tax rate (in addition to any other income, for instance, their employment) and then pay for those living and education expenses with after-tax income. These tax savings continue generation upon generation so that your children can ultimately then apply tax free amounts to their children.

Imagine paying for school fees with tax free income – what a difference that could make!

CASE STUDY: YOU HAVE CHILDREN OVER 18

If you have adult children, you should consider leaving an inheritance to them through a testamentary trust, rather than as a direct gift.

If you choose, your child can still control “their” testamentary trust (so it looks and feels like their money), but using the testamentary trust will give them the following advantages:

- The inherence you leave your child is significantly less likely to be exposed to any family law property settlement risks if your child separates or divorces

- If your child is in a high risk occupation (e.g. carrying on a business, a director, or at risk of negligence – hello engineers, lawyers, doctors, accountants, health professionals etc!), then the inheritance you leave your child could be exposed to those risks if you do not use a testamentary trust. A testamentary trust protects the inheritance from any bankruptcy claims.

- The tax treatment could amplify the impact of the inheritance, because they can access tax free income to pay for their children’s (i.e. your grandchildren’s) living and education expenses.

For example: If you leave an inheritance to your child who has 3 minor children of their own, then roughly the first $62,000 of income earned from investing the inheritance through the trust could be tax free and used to pay for your grandchildren’s living and education expenses.

If you didn’t have a trust, then your child would need to pay tax on that income at their marginal tax rate (in addition to any other income they may earn from other sources) and then pay for those living and education expenses with after tax income. These tax savings continue generation upon generation so that your grandchildren can ultimately then apply tax free amounts to their children and so on.

WHO WILL BENEFIT FROM INCLUDING A TESTAMENTARY TRUST IN THEIR WILL?

If you tick even just one of the following boxes then you should consider using a testamentary trust in your will:

- You are leaving at least $500,000 (including super and life insurance) to one or more people

- You want to leave an inheritance to minors who can each receive approximately $20,000 tax free income each year from investing the inheritance

- It is important to you that the inheritance is protected from relationship risks (e.g. divorce or separation)

- It is important to you that the inheritance is protected from bankruptcy risks

- You are leaving assets to a beneficiary who cannot be trusted to manage their inheritance appropriately and you are worried they will waste it

- An intended beneficiary is currently residing overseas

There are a few more complexities but in essence, these are the main principles of testamentary trusts. They shoiuld serve as guidance only, and the legal strategy should always be approved by a qualified lawyer.